Perhaps the most interesting part of the article:

wow, its almost as if we should cut off the heads of insurance CEOs and nationalize them all into one low cost government plan thats paid for with pennies on the dollar in taxes.

lol, who am I kidding. Idiot Americans will always prefer paying 3000 dollars for bad coverage, rather than pay 100 in taxes for great coverage.

With climate change, there is no option for “low cost” plan, government or no.

You can’t constantly have massive losses like these fires in a single area all paying out claims and expect to pay them off with low premiums.

I haven’t seen it in the comments yet but this is just the death spiral of climate change. Everything will just get worse from here on out as long as society operates the way it does. To everyone’s “surprise” I’m sure.

Yeah, I really do wonder when the government and rest of the people start to seriously consider if it is worth it dropping $50 billion on places like SoCal and South Florida every few years or so. At some point you need to do the math and ask hard questions about whether it is worth it, and the answer damn well may be no.

Yeah the point flew way over that guys head

Did you pull a muscle? You know, stretching that hard to intentionally misconstrue what I said.

Seems to me that’s exactly what you said.

You had me at cutting off the heads of CEOs.

Guillotines go brrrrrrrrr

Or, you know, tackle climate change. But both are equally unlikely.

You’d think that insurance companies would be on the forefront of pushing climate change mitigation and prevention specifically because the impacts of worsening climate change will have a massive impact on their bottom line.

Maybe they can counter some of the petro company propaganda with their own marketing.

They’re in the business of making money, not fixing problems. It’s easier to just pull out of an unprofitable area than fix the Republican party’s head-in-their-ass ideas about climate change.

BUT MUH TAXESS

Speaking of the Palisades fire, I’m not sure if anyone has looked into this yet, but they probably should:

Fact-check that, Sugar-Mountain!

It’s true. I read it on the internet.

Everyone is saying it.

Someone should adjust the silhouette to look like Mario bros Luigi

The exposure isn’t quite right and there are artifacts, but I am not a graphic designer so 🤷

The exposure isn’t quite right and there are artifacts, but I am not a graphic designer so 🤷It’s beautiful lol, your skills are apt. I meant the Batman on the building silhouette but this is equally cool

I meant the Batman on the building silhouette

Aww dammit 😅

I think the curious aspect of this is that business is absolutely aware, and acknowledges existence of the climate change.

They should be putting in effort to reduce climate change impacts. It’s in their financial interest, even if they have no capability to have a moral motivation

Insurance companies are scummy but the headline phrasing makes it seem like they JUST canceled the policies…but no, it was 6 months ago.

As much as I want to hate them for it, can you really blame them? Insurance operates under the measured assumption that most people won’t have to use it for some major. When wildfires become probable, it’s almost guaranteed to cost them exponentially more than homeowners paid in premiums.

Even if insurance cost $50,000/year, it would take several years of payments to cover the payout. And California has wildfires yearly.

For some reason you made me think of banks being covered by government insurance. In a way you’d think the government would also insure land, seeing as that’s one of the main things they protect.

The logistics would probably be horrible for that type of thing though.

Government can print money when appropriate and not abused. Payments directly to the general public are the best type of stimulus. Take a bad situation and make it a stimulus.

Part two though has to be that they are not allowed to receive a payout more than once or make it illegal to build new construction in wildfire zones until they have figured out the forest management issues.

Practically everywhere is a wildfire zone though. Yes we need much more forest management, infrastructure hardening, fire resources, etc, but giving folks a one time payout and then they move to another area that gets destroyed and now they don’t get support doesn’t seem helpful since we can’t really predict what will burn. It’s simply harder than e.g. flood mapping.

There aren’t really forestry issues at all.

This is why insurance shouldn’t be for profit.

I think you might have missed the point.

I mean it would be great to have some kind of socialised home insurance that wasn’t “for profit”, but such a scheme should still refuse to insure homes which are likely to burn down.

That probably sounds good in your head. But you are only thinking of fires. What if they just pick the highest risk factor for every house and refuse to cover that. Then what would be the point of the insurance. And if you consider all the houses that are a high risk for something… fire, hurricane, flooding, high winds, tornadoes, earthquakes… you aren’t left with many houses.

What a silly thing to say.

Obviously, if one insurer refused to cover what ever thing, they would lose all their customers to other insurers who covered sensible risks.

The point is, you can’t insure against risks that are too likely to occur.

Insurances need to cover their expected cost with the rates, otherwise they won’t be able to cover in case of an incident. Nobody will run an insurance expecting a loss, and you can’t force anyone to.

The alternative is like when we had flood that the state bails out the boomers who bought houses when they were cheap in areas where insurance won’t insure because of risk, paid with taxes by people like me who have a hard time acquiring property because taxes and other cost are so high due to decisions their generation and earlier ones made.

Of course, this is somewhat exaggerated; they also pay taxes. But it’s also not completely wrong.

In the particular case of a previous colleague’s house getting flooded, I always had to think of the fact that she chose to fly a certain route for work to save about 2 hours because it’s just so much more convenient than the train.

I mean it would have happened with it without her flying, but still thought about it.

They could cover a lot more if they didn’t need to make billions in profit. But your general concern is valid. What stops people from building in extremely high risk places. The answer should be federal building standards. If a house is built in a high risk area, it must have mitigating features that protect it from the high risk, or it can’t be built. Local building codes already do this sort of thing. So this is just an extension of something already done. Most people don’t know which areas are high risk for what. So don’t penalize them for getting duped. And in many cases the house wasn’t in a high risk area when built. So there needs to be funding to upgrade those houses to reduce the risk. That should come from the industries that profitted on ignoring the effects of thier industry in exchange for great profits.

You don’t have to drop the entire area though, you just have to drop forest fires as a claimable item.

Then people can make a decision on if that’s okay for them, or try to find someone else.

Would this not most likely still cause the same kind of financial collapse in the housing market that was mentioned as a possibility in the article linked by OP? If it is not possible to get insurance for an event (i.e. wildfire) that is likely(/definitely going) to occur, then I imagine buyers/real-estate developers would be less inclined to pay high prices in those regions.

I think we’re likely to see a collapse of housing markets in places like CA and FL no matter what.

I know some areas have laws mandating certain minimal coverages. I wonder if the insurers would even be allowed to issue policies that didn’t cover wildfires.

If that’s the case, we might see some laws changing in the near future.

Especially for the palisades $3,500,000 homes.

At $50,000 a year it would take 70 years of payments.

Well, it should be proportional to the value they’re covering * the risk of loss, so they’re probably paying much more than $50000/year.

As much as I want to hate them for it, can you really blame them?

Yes; go sue big oil who fucking knew since the 60’s climate change was inevitable if nothing changed. Make those fuckers pay dearly.

When your insurance drops your coverage, that’s your cue to GET THE FUCK OUT BEFORE YOU HAVE YET LOST EVERYTHING.

Those actuarial tables are designed from the ground up and refined over literally decades (up to around a century in some cases) to predict risk and while they’re not always perfectly accurate they are clearly ENOUGH so that they have made it possible for insurers to remain profitable.

IF THEY KNOW ANYTHING THAT YOU DON’T, THEY ARE DEFINITELY ACTING ON IT.

I know you can’t literally just drop everything, or fit absolutely everything that matters to you in your car in a pinch, but you WILL be better off if you’ve packed up and prepped for transport as many as possible of the things that would hurt you and/or inconvenience you the most to leave behind.

So for those of you who haven’t already experienced total loss, learn from this. Prepare yourselves. The people displaced by this will strain many other extant failure points in our society. Shit is about to get MUCH, MUCH WORSE.

Likewise there’s a reason all the billionaires are building bunkers in Hawaii and New Zealand and investing in yachts, that Greenland and northern Canada have new geopolitical and economic importance, and that the Panama Canal is at risk of not being able to get enough traffic across. I’m tired of getting gaslit by climate naysayers.

“Everything is fine!” they say as they stockpile supplies and build secret locations to hide.

The warning bell rang decades ago and we’re still ignoring it. There is no escaping or planning around what is to come. It doesn’t matter if you move somewhere less impacted by climate change. Those places can’t support anywhere close to the amount of people that will need to live there. We’ll ruin those places fighting over what scraps remain until there’s nowhere left to go.

The entire world basically just tried to ignore COVID and kept burying the bodies hoping everyone would stop caring. (BTW, excess death statistics are still horrifically higher than pre-2019 levels across the world)

Long COVID is a literal debilitating lifelong mental and physical disability but everyone has it now so we just don’t care.

It’s simple. The bourgeois must be eliminated or humanity dies.

I had to get out of Public Health because of the damage pretending covid was over was doing in almost every sense.

I’m already in a place that is less susceptible to climatological ruin. I’ve resigned myself to the inevitability that billions will die. Regardless, my preparatory steps shall continue to be “make room”. I’m going to personally see to it that IF by some miracle I actually manage to survive, I bring as many people with me as possible; failing that, I hope to find a way to enable more people to survive EVEN IF it kills me.

The problem is that people cannot simply get out at scale. The homes themselves are not portable and represent a significant investment that most homeowners cannot afford to lose. An individual can sell, but that requires there being a buyer, so doesn’t actually solve the problem.

What is needed here is a government funded relocation program. The government buys houses in eligible areas at market rate (locked in at the time the program starts, as market rate should collapse to 0). Then, the government does nothing, and saves money from not needing to subsidize the insurance market, and need needing to spend as much on disaster response and relief. Given that the disaster relief savings is largely born by the federal government, this program should receive federal funding as well.

So someone has say 2 million in real estate and 1.5 million in other Investements. They are at risk of losing some of that 3.5M while still counting themselves wealthy and the government who can’t afford to provide a whole laundry list of shit for normal people just hands them a few million to ensure their bad decisions don’t cost them anything.

How about we don’t subsidize your insurance and if you suck up you just lose your money.

Why should my tax dollars be used to bail out someone who bought a multimillion dollar home in a high risk area? Why should home owners get all the profits from owning but get to skirt the risks?

That’s an easy one. Because the government let this happen by not reigning in the corporate pollution it knew was happenig. All so the economy would grow and grow which is what gave you the money to pay those taxes. So the tax dollars you are giving the gov are the reason these people need to move.

I think relocation (and getting people comfortable with their tax dollars going towards it) would work better if the US states weren’t so ideologically divided.

There is no way I want the average republican relocating to my state, let alone wanting to pay for such punishment.

This is a terrible idea.

We bought our present home 6 years ago. One house we looked at was in a low lying area, probably less than a metre above the high tide line. We didn’t buy that home because I’m not an idiot.

Since the dawn of time people have been building homes in silly places and losing their money as a result. It’s a shame.

In the next century there’s going to be a great many people displaced due to climate change. Let’s not start out by indemnifying those who pretended climate change wasn’t a thing.

When was that house built? What should the current owners do with it? If they sell, someone else needs to buy. Someone is going to be left holding the bag for a decision made decades ago.

And our current approach already indemnifies them, because their flood insurance is provided by the federal government as no private insurer will offer it. Then, when a flood hits, we all pay for it, along with the emergency response during and after the event.

I’m somewhat astonished that you think owners of this type of property ought to be indemnified in any way.

If I inherited such a property, I would absolutely try to find a “greater fool” to buy it.

I would point out though, properties like that aren’t going to be unsaleable over night. They’re just going to be less desirable than other properties.

It was always a terrible idea for the government to offer insurance when private insurers wouldn’t. It just forces everyone to subsidize the lifestyles of people who choose to live in disaster-prone areas. Perhaps it was necessary for a time to avoid major economic upheaval, but constantly rebuilding in areas where disasters keep happening should never have been allowed to become a long-term policy.

The government shouldn’t offer insurance the market won’t. The person holding the bag is the most recent idiot.

What if they bought before the 70s? Before climate change was taught in schools?

We all know who’s responsible for it.

Petroleum companies, oil and plastics added so much pollution in such a short amount of time the planet couldn’t deal with it and it’s likely led to significant, global-level environmental impact.

Sure, but even they didn’t know they were destroying the climate until the 70s

Then they have PLENTY of equity to move to a place better suited to their risk tolerance.

In the US, voters have shown over and over that they don’t care if a lot of people become homeless. Why would you expect them to care about people who become homeless because of fires than they do about people who become homeless because of economic conditions?

The issue isn’t just local. “This is predicted to cascade into plunging property values in communities where insurance becomes impossible to find or prohibitively expensive - a collapse in property values with the potential to trigger a full-scale financial crisis similar to what occurred in 2008,” the report stressed.

I know this isn’t the main point of this threadpost, but I think this is another way in which allowing housing to be a store of value and an investment instead of a basic right (i.e. decommodifying it) sets us up for failure as a society. Not only does it incentivize hoarding and gentrification while the number of homeless continues to grow, it completely tanks our ability to relocate - which is a crucial component to our ability to adapt to the changing physical world around us.

Think of all the expensive L.A. houses that just burned. All that value wasted, “up in smoke”. How much of those homes’ value is because of demand/supply, and how much is from their owners deciding to invest in their resale value? How much money, how much human time and effort could have been invested elsewhere over the years? Notably into the parts of a community that can more reliably survive displacement, like tools and skills. I don’t want to argue that “surviving displacement” should become an everyday focus, rather the opposite: decommodifying housing could relax the existing investment incentives towards house market value. When your ability to live in a home goes from “mostly only guaranteed by how much you can sell your current home” to “basically guaranteed (according to society’s current capabilities)”, people will more often decide to invest their money, time, and effort into literally anything else than increasing their houses’ resale value. In my opinion, this would mechanically lead to a society that loses less to forest fires and many other climate “disasters”.

I have heard that Japan almost has a culture of disposable-yet-non-fungible homes: a house is built to last its’ builders’/owners’ lifetime at most, and when the plot of land is sold the new owner will tear down the existing house to build their own. I don’t know enough to say how - or if - this ties into the archipelago’s relative overabundance of tsunamis, earthquakes, and other natural disasters, but from the outside it seems like many parts of the USA could benefit from moving closer to this Japanese relationship with homes.

As far as the value of the home, you need to consider rebuilding costs. New construction costs in the LA area are on average $440 and higher for custom work.

At those prices, a new house, without the land, will cost at least $500000 to build (also note that a 1130 sq ft house isn’t really what most people want to buy, as the average new house size is around 2000 sq ft, putting the cost of a basic house at $880000, again without the land).

While I mostly agree with your line of thinking, I do feel the urge to point out that most of the value of property is tied to the land underneath the structure, rather than the building itself.

This is largely why one of those Sears catalogue 2-3 bedroom post-war homes is worth significantly more than a similar footprint modern apartment/townhouse a few doors down.

The houses themselves are often seen as a depreciating asset; and for the more unscrupulous land-bankers, these fires just became free demolition.

I guess what I’m saying is, shit’s even more fucked than you thought… and until we get rid of milquetoast liberal politicians and replace them with actual populist progressives globally, it will only continue to get worse.

I see this sentiment frequently. What I don’t see, though, is how this can cmbe achieved short of government owned uniform housing. Maybe I’m missing something, though. Can you helpe understand?

With regard to Japan, you’re right, single family homes aren’t intended to last all that long. This is largely because building standards there change so rapidly thst building something that lasts means that you wasted money. Even if it is built to last, it will fall out of code in a way that it will devalue over time.

That doesn’t happen in the US because we don’t have the same frequency of disasters and the same rate of change in building codes. Maybe that will change moving forward, though, given the increased frequency of disasters in the US due to climate change.

Throw a few of these up in every city. Would go a long ways quickly to solving problems.

So, projects? I would love to see a solution to home prices and the inequality they create but I think projects have been shown to work out poorly in the US.

They only work out poorly in some plsces due to neglect. You have to give social services to the residents.

Oh good megablock housing. I’m sure that won’t be abused in any way whatsoever

As opposed to the suburban sprawl we have now? Every lawn fertilized, every driveway 2.5 cars? Or the shanty towns?

It turns out building housing is as easy as building housing. I would absolutely live in one of these if they were correctly managed. A half a billion Chinese people can’t be all that wrong.

Funny how the rich argue with climate change when it benefits them. For decades they denied it fiercely and now it’s time to pay… even if we take all from them (which we should) it’s not enough repair the damages their behavior caused.

There are many blue voters who live in areas affected by the Palisades fire

Blue voters that happily generate more carbon that most of us.

Meanwhile the insurance companies are throwing parties right now for pulling out ahead of the disaster. Probably tweaking their models to make sure they’re not at risk anywhere else.

Don’t worry though, the incoming administration will be working with local governments to prepare for future challenges… Or ignoring them and dismantling any and all efforts to mitigate climate disasters. One or the other.

The insurance companies had an obligation to maximize shareholder value. That is the sole purpose of insurance companies.

The insurance companies had an obligation to maximize shareholder value. That is the sole purpose of insurance companies.

Look, I get that this is an easy go-to answer for many things, but please add this to expand your understanding a bit more so you have a more complete picture.

Not all insurance companies are public companies with shareholders to satisfy. Mutual Insurance companies are owned by their policy holders. Specifically with California, both State Farm and Liberty Mutual have both exited too. These are both large insurance companies that are NOT driven by “shareholder value”. Profits these companies make are issues as dividends to the policy holders, not shareholders.

So the issue of insuring property in California is more than just the standard “greedy shareholders” argument.

This is a really dumb take. Pulling out of a market where it’s impossible to even break even is not greedy or corrupt.

Yoink goes the coverage that you paid into!

And the shareholders rejoice.

Your homelessness is a you problem. You should have paid for some coverage in the event of such an occurrence.

That’s not how it works at all. You’re thinking of health insurance. This thread is about insurers declining to renew contracts, not denying claims.

This thread is about insurers declining to renew contracts, not denying claims.

So hanging around to extract insurance premiums for as long as possible, then fucking off before they have to start making any of that money flow in the other direction?

FFS, no. Do you even know what insurance is? They are always on the hook to make payouts for any policies that are active, and it happens regularly. Most of the money they take in goes toward paying claims. Most of the rest of the money goes toward overhead, which includes paying actuaries to evaluate how much risk they’re taking on and how much future payouts are going to cost. They determined that providing homeowners’ insurance in CA would soon cost them more in payouts than the state allows them to charge in premiums, so they decided to stop doing business in CA. Nobody was scammed. Their customers all got what they paid for while they were paying for it.

This reads like apologia for the insurance industry. Note the glaring absence of you mentioning their fiduciary responsibility to maximize shareholder value. I can almost see the vein on your forehead throbbing as you try to explain what insurance is to me. I understand how insurance works, but am resisting the almost overwhelming urge to reply KenM style.

Yoinking an insurance policy for my Fabrige egg collection, because I won’t stop juggling them? Cool.

Yoinking coverage for my my home, which I’m basically anchored to (proximity to work, schools etc.), while you slink off with your profits? Not so cool.

What does “uninsurable home” do to property values? The insurance companies will do fine, while I’m left to sort this out (lose everything).

I understand why they pulled out. Do you grasp the notion that home owners can’t instantly pull up stakes and teleport to more insurable locations? Do you understand how the non-insurability aggressively power-fucks those stranded home owners ability to salvage any equity in their homes?

The guillotines will be adorned with the Surprised Pikachu face.

Note the glaring absence of you mentioning their fiduciary responsibility to maximize shareholder value.

A lot of insurance companies, including big ones like State Farm and Liberty Mutual, are owned by their policy holders. So yeah, I made the mistake of not mentioning their fiduciary duty to maximize value for their customers.

Do you grasp the notion that home owners can’t instantly pull up stakes and teleport to more insurable locations?

What do you expect insurance companies to do about it? Keep offering policies and collecting premiums while knowing they won’t be able to pay all the claims they get? That’s called fraud.

You say they’re “slinking off” as if they’ve stolen something, but what have they stolen? You say they’re leaving with their profits, but what profits are you referring to? Do you really think they’d be leaving if they were making money?

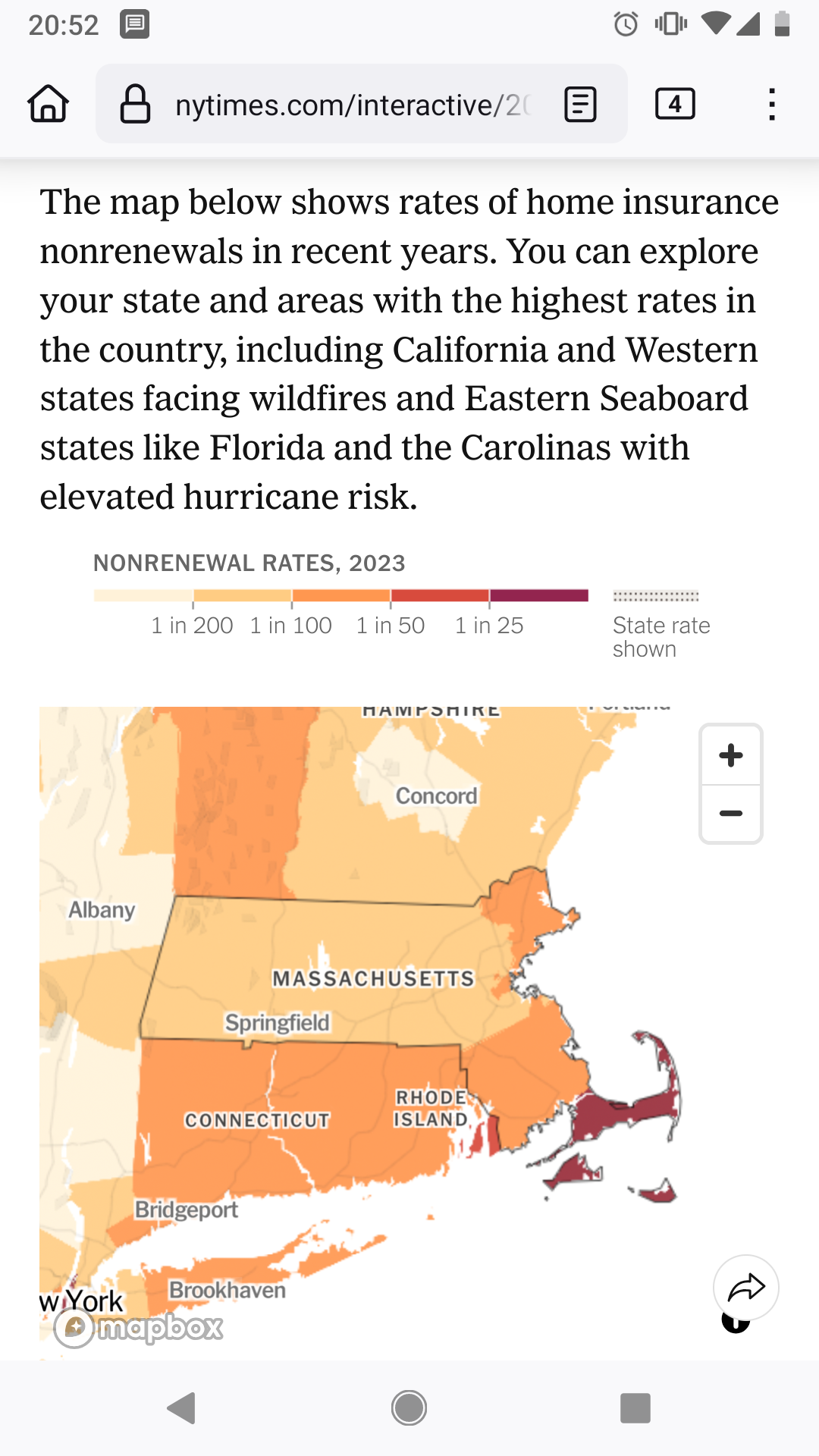

The map below shows rates of home insurance nonrenewals in recent years. You can explore your state and areas with the highest rates in the country, including California and Western states facing wildfires and Eastern Seaboard states like Florida and the Carolinas with elevated hurricane risk.

I’m sorry, are we just skipping over the regulations that caused these companies to pull out? Most of these homes would still be covered. They’d be paying a higher price, but they’d be covered.

When you put a legal cap on costs, the company will pull out.

Turns out when you say you cannot charge more than x for a service that costs y to provide, and y>x, no one can sell the service.

Insurance companies fucking suck, but too many think their profits are the ONLY reason there is a problem.

Yea that’s just basic economics.

Maybe we should have rules in place that provide more protection for actual human beings instead of prioritizing profit margins or pretending that “Basic Economics” is a universal law rather than a guideline of how people interact with each other. Sorry, I’m not mad at you, just the system we live in

We, did, they were pushed to the side. Those rules and protections were building more reservoirs, keeping those and the current ones full of water, continuous upkeep on fire hydrants, rehiring firefighters who were fired for not taking the vax, regular controlled burns, clearing out the undergrowth, not dumping water into the ocean after rainfall… So, so many that were completely abandoned.

You seem to think the prices for fire protection came out of nowhere, but they don’t. As these precautions were abandoned one by one, fire insurance went up, because the likelihood of a fire grew exponentially. When government put a cap on price, that effectively made it clear that the company would go bankrupt, completely, because they knew a fire was going to happen eventually.

We should be mad that those very protections put in place to help people were taken away by the government, not the companies.

Por que no los dos? The government is NOT faultless in this, but how often are those regulations removed because a company lobbyist

bribed themhinted very strongly that they would like that?

Man insurance is such a scam. They’ll only actually offer hypothetical coverage if they know you won’t need it 😅

Actually need it? “Well, we have to make a profit! Why would we pay for that thing you’re paying us to cover?”

I can’t help but see it this way too. And healthcare before some of the ACA’s protections was similar. “Yes, give us those premiums, everything’s looking pretty safe, we’ve got you covered if something happens! Wink wink, nothing does really, so we’ve got you!”

And then the moment that changes, it’s “woah there, too risky for us, are you crazy? We’re gonna lose money! You’re on your own”. And all the 10s of thousands paid when times were good and there was very little likelihood you’d need help are just gone, and fuck you.

I understand insurance companies only make sense if the risk of paying out heavily is small enough. But still, you paid to be covered when the shit gets bad, they should have to taper down over time or return some premiums or something. Not just “welp thanks for all the money, it looks like we’re gonna have to start giving some out soon so we’re just gonna stop here while we’re ahead”. It’s just a legal scam.

Don’t forget it used to be “We’ve got you covered except for the thing you’re actually sick with.” from when they refused pre-existing conditions.

Man insurance is such a scam. They’ll only actually offer hypothetical coverage if they know you won’t need it 😅

Actually need it? “Well, we have to make a profit! Why would we pay for that thing you’re paying us to cover?”

An insurance company takes the data it has about whatever someone wants to insure, uses its actuarial system to find out what its risk value is, and then charges you slightly more than that value over time.

You will probably never need the service, but if you do, they’ll help you out. Because they’re charging more than the actual risk value, over time and over a large enough subset of clients, they’ll make some profit, even while paying to replace or fix people’s houses. Which is fine, they are providing a service and there’s absolutely nothing wrong with profiting from providing a service. You win, they win, everyone benefits.

In return, you get the peace of mind of knowing that if the worst happens, you’ll be at least somewhat better off and able to afford to rebuild.

If the risk of event X gets too high in an area, and the company isn’t allowed to say, “You’re covered for everything but X,” the company would either need to charge enough to cover essentially the value of the house on such a short timeframe as to be untenable, or stop providing coverage. They don’t have infinite money, so if they‘re forced to provide coverage at a lower rate than the risk level, and something like a massive hurricane or flood or fire happens, they go bankrupt. Now no one gets their house rebuilt.

Just because a company only operates where they make a profit doesn’t make them a scam. They aren’t a charity or a public service.

Yeah it is. I made a claim for hail damage then It made me uninsurable/insane premiums when I moved for 5 year, no fault thing from mother nature but ya know it’s my fault they had to pay out. I was told if I made 3 or more claims in 5 years I be uninsurable, hoping my home stays safe from this fire that’s 2miles away from me…

The thing is if you buy a home and in California it’s likely 1mm plus in the la region. You’re paying huge mortgage rate more so with insurance and the recent rates basically house poor. If you loose your house you still have to pay the bank so you can’t afford to live anywhere right? So with out insurance buying a home is one step away from being destitute?

It’s needs to be a state sponsored thing and nonprofit. Like fire departments if everyone loses their home who’s left to taxes, or even stay there.

I live 1 mile from the no insurance zone and in Los Angeles it took me weeks to find anyone to even cover our home after being dropped because “we have a flat roof” we don’t, it’s bs excuse.

Seems to me non privilege stuff should be a government run thing. Everyone should have a right to health care and housing and food. None of this shit should be for profit, fuck insurance.

Sorry realized I went on a rant.

I’m in a safe-ish area and was told 2 claims in 3 years and they wouldn’t renew my insurance. Been here over 20 years and had one claim 10 years ago.

Had lightning hit and called the insurance directly, they opened a claim number but we ended up not using it. Meaning they paid $0 because it turned out to be a simple fix, it was just scary in the moment at 3am with water gushing out (not into the house). So we just paid the $300 to fix it and they closed the claim.

Two years after that we called when a tree hit the house, went a different route and called the independent agent first, not the insurance company directly and that’s when we learned if we started a claim for the tree damage, they probably wouldn’t renew. Ended up being almost $3000 out of pocket so we can keep the house insured and the mortgage company happy.

Yeah that’s the worst, even if you just call them to ask if something is covered they will still make a note and use it against you.

The insurance companies gotta keep their shareholders happy. That is the number 1 priority and fuck the customer.

I completely get the eat the rich mentality. At the same time, it really doesn’t make sense to rebuild some of these places. We’re all paying for it one way or another.

/a rub living in a flyover state that’s very boring from a climate change perspective, at least so far.

Did the CEO’s house burns down in the wild fire as well?