The Centre for Research on Energy and Clean Air (CREA) and Global Energy Monitor (GEM) have released their H2 2024 biannual review of China’s coal projects, which finds that coal is still holding strong despite skyrocketing clean energy additions in 2024.

Even as China’s clean energy surged in 2024 and became a key economic driver, solar and wind utilisation dropped sharply in Q4 2024, which was not expected or explained by weather conditions, and coal remains strong, which ultimately goes against President Xi’s 2021 pledge to phase down coal over the following five years.

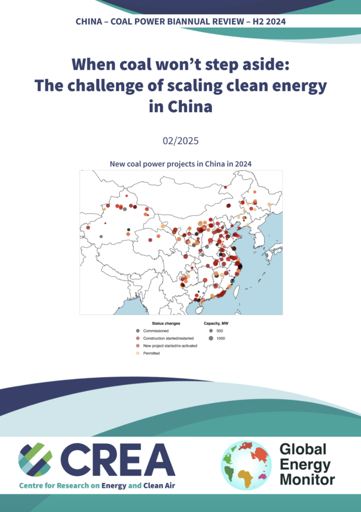

China approved 66.7 gigawatts (GW) of new coal-fired power capacity in 2024, with approvals picking up in the second half after a slower start to the year. At the same time, 94.5 GW of new coal power projects started construction and 3.3 GW of suspended projects resumed construction in 2024, the highest level since 2015, signalling a substantial number of new plants will come online in the next 2-3 years, further solidifying coal’s role in the power system.

…

Key findings:

- Coal power permits and new project activity remain high despite some signs of slowing. In 2024, 66.7 GW of new coal power capacity was permitted – lower than previous years but still well above the levels seen in the first half of the year. Meanwhile, new and revived coal power proposals totalled 68.9 GW, down from 117 GW in 2023 and 146 GW in 2022, suggesting a potential cooling in project initiation.

- Coal power construction starts reached their highest level since 2015. 94.5 GW of new coal capacity began construction, the most since 2015, highlighting continued momentum in project development despite President Xi Jinping’s pledge in 2021 to ‘strictly control coal power projects’. However, actual commissioning has slowed, with 30.5 GW coming online so far, down from 49.8 GW last year but in line with 2021 and 2022 levels.

- China’s coal power expansion contrasts with global trends. While China continues to add new capacity, the global coal fleet outside China shrank by 9.2 GW in 2024, reinforcing China’s dominant role in shaping the future of coal power. China now accounts for 93% of global construction starts for coal power in 2024.

- Long-term coal power contracts are reinforcing coal’s dominance at the expense of renewables. Electricity buyers locked into long-term coal power contracts face penalties if they fail to purchase contracted volumes, discouraging them from prioritising clean energy. With new coal capacity coming online, guaranteed operating hours under pre-signed agreements further limit grid space for renewables, delaying the transition to a cleaner energy mix.

- Coal mining companies are playing a dominant role in financing new coal power projects. In 2024, more than 75% of newly approved coal power capacity was backed by coal mining companies or energy groups with coal mining operations, artificially driving up coal demand even when market fundamentals do not justify it. This not only reinforces reliance on coal but also risks undermining central government policy targets for curbing coal consumption and accelerating the energy transition.

- Despite policy intentions for coal power to support renewable integration, 2024 approvals show a shift away from this role, with many projects justified by local governments based on economic development and local energy security instead. While some policies promote coal power flexibility retrofits, long-term contracts and the inherent limitations of coal plants regarding low-load operation and intra-day cycling discourage coal plants from performing a true regulating function.

"China also put up 357 gigawatts of solar and wind, a 45% and 18% increase, respectively, over what was operating at the end of 2023, according to China’s National Energy Administration. That’s akin to building 357 full-size nuclear plants in one year.

The installations meant China surpassed a goal, six years early, of having 1,200 gigawatts from renewables by 2030, a benchmark Chinese President Xi Jinping set five years ago."

Helpful context that their solar and wind dwarfs coal.

In 2023 60.5% of China’s electricity was produced by coal power plants.

In 2024, 66.7 GW of new coal power capacity was permitted

Just to compare the EU has 87.6GW of coal power plants in operation in 2024. So China just permitted 76% of the EUs total capacity in coal power plants within a single year.

Yeah, the report clearly says that China’s reliance on coal undermines this. Therefore, the bottom line for China doesn’t look too good according to the Climate Action Tracker - China:

- Policies and action against fair share: Insufficient

- NDC target against modelled domestic pathways: Highly insufficient

- NDC target against fair share: Insufficient

- **Overall rating: Highly insufficient

China is as much as most countries on the wrong track.

It seems the problem is the regional governments , which are prioritising regional coal mining, to prioritise regional jobs. In China there is plenty of renewable energy capacity but the sun and wind are mainly in the W and S, while the old coal mines are in the E and N. China has plenty of climate scientists and diplomats pushing central government policy, but these have less influence on ‘local government’. As many ‘local governments’ in China govern populations larger than European countries, this is something like Poland trying to keep it’s coal mines alive, in contradiction to European climate policy. Eventually there will be surplus energy, some coal contracts are going to break, question is who wins and loses then. Western observers tend to think of China as a big centrally controlled monolith - it isn’t, the ‘local’ chiefs have a lot of power. Similar central / ‘local’ governance problem with housing bubble and debt.